The pursuit of economic growth has long been a cornerstone of national development strategies worldwide. Yet, beneath the headlines of GDP figures and market indices, a stark reality persists: the distribution of this growth is often anything but equitable. Economic inequality, manifested in both income and wealth disparities, presents one of the most pressing challenges of our era, threatening social cohesion and economic stability. For a nation like India, grappling with its own significant disparities, understanding the global landscape of inequality offers crucial insights. But where, across our diverse planet, are these divides most pronounced?

The Stark Divide: Global Hotspots of Disparity

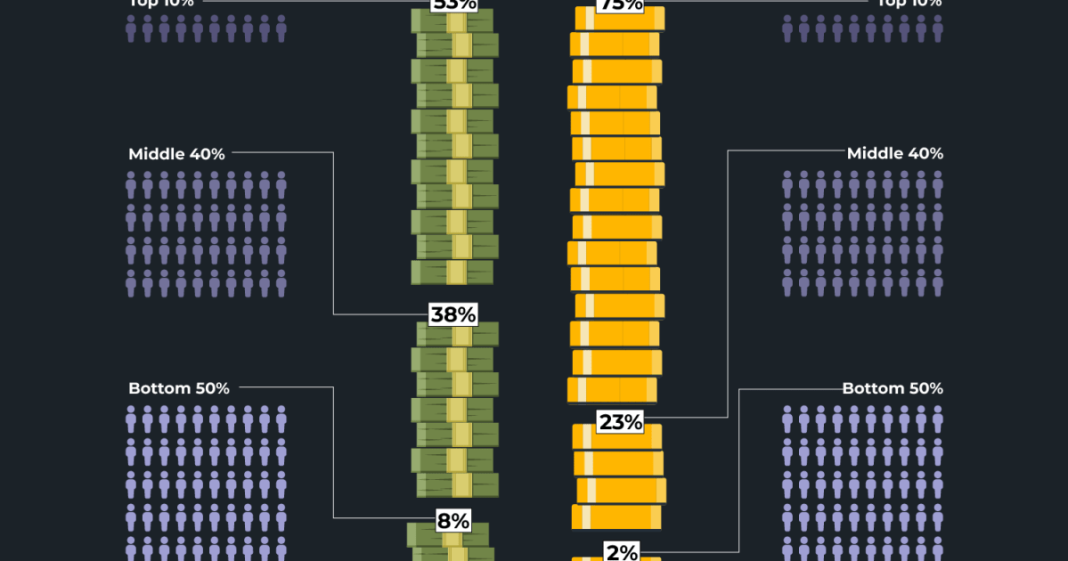

Understanding where wealth and income are most unequal requires examining various metrics, primarily the Gini coefficient, which measures income distribution, and the share of wealth held by the richest percentile. Globally, the picture is complex, with certain regions consistently exhibiting higher levels of disparity.

Latin America, for instance, has historically been a stronghold of income inequality. Countries like Brazil, Colombia, and Chile have long struggled with vast gaps between their richest and poorest citizens, often rooted in colonial legacies, unequal land distribution, and limited access to quality education and healthcare for marginalized populations. Similarly, large parts of Sub-Saharan Africa, despite recent economic growth, continue to face extreme income and wealth concentration, exacerbated by resource dependence, weak governance, and historical injustices. South Africa stands out as one of the most unequal countries globally by most measures, a direct legacy of apartheid.

However, income inequality tells only part of the story. Wealth inequality, which includes assets like property, stocks, and savings, is often far more entrenched and even higher than income inequality in many nations. Even in developed economies like the United States, while income inequality is significant, wealth concentration among the top 1% and 0.1% is particularly striking. Here, the accumulation of inherited wealth, coupled with appreciating financial and real estate assets, creates a widening chasm that is harder to bridge through income alone. The financialisation of economies, where returns on capital often outpace returns on labour, further exacerbates this trend.

Beyond Income: The Entrenchment of Wealth Gaps

The distinction between income and wealth inequality is critical. Income inequality reflects the annual flow of earnings, while wealth inequality represents the accumulated stock of assets over a lifetime and across generations. It’s wealth that often grants political influence, determines access to opportunities, and provides a buffer against economic shocks.

When we look specifically at wealth inequality, the concentration is often staggering. A 2023 report by Oxfam highlighted that the richest 1% globally now own nearly half of all financial wealth. This concentration isn’t confined to particular developing regions. While emerging economies often show high income inequality due to rapid, uneven growth, some established economies also exhibit extreme wealth concentration. For example, countries known for strong social safety nets, like some in Scandinavia, tend to have lower income inequality but still grapple with substantial wealth disparities. This indicates that even robust welfare states struggle to fully mitigate the generational transfer of assets.

India, often referred to as a “billionaire factory,” finds itself squarely within this global conversation on extreme inequality. Recent analyses consistently place India among the nations with the highest wealth and income disparities. The country’s rapid economic ascent has disproportionately benefited a small segment of the population, leaving a vast majority struggling with precarious incomes and limited asset ownership. Factors such as a large informal sector, inadequate social security, and an urban-rural divide contribute significantly to this chasm. As Nobel laureate Amartra Sen once remarked, “Poverty is not just a lack of money; it is a lack of capability to lead a full life.” This sentiment powerfully underscores how profound economic inequality constrains human potential.

The mechanisms driving this global trend are multifaceted. They include regressive tax policies, weakening labour protections, insufficient public investment in education and healthcare, and the unchecked power of monopolies. For many developing nations, including India, historical factors like colonial exploitation and structural biases continue to cast a long shadow, perpetuating cycles of disadvantage for specific communities.

The question of where wealth and income are most unequal yields a complex answer, pointing to regions as diverse as Latin America, Sub-Saharan Africa, and even certain developed economies. While income disparities are often most acute in developing nations undergoing rapid, uneven growth, wealth inequality is a pervasive global phenomenon, often more entrenched and harder to dislodge, reflecting generational transfers and asset appreciation. For India, this global picture serves as both a mirror and a warning. Addressing these profound disparities requires not just economic growth, but a concerted effort towards inclusive policies, robust social safety nets, and equitable opportunities for all, ensuring that prosperity is not just a privilege for a few, but a possibility for everyone.