Quick Summary

Arre yaar! The US stock market had a bit of a rough day on January 23, 2026. The Dow Jones Industrial Average took a tumble, and tech giant Intel’s stock price saw a significant slide. Investors are definitely keeping an eye on these developments!

What Happened

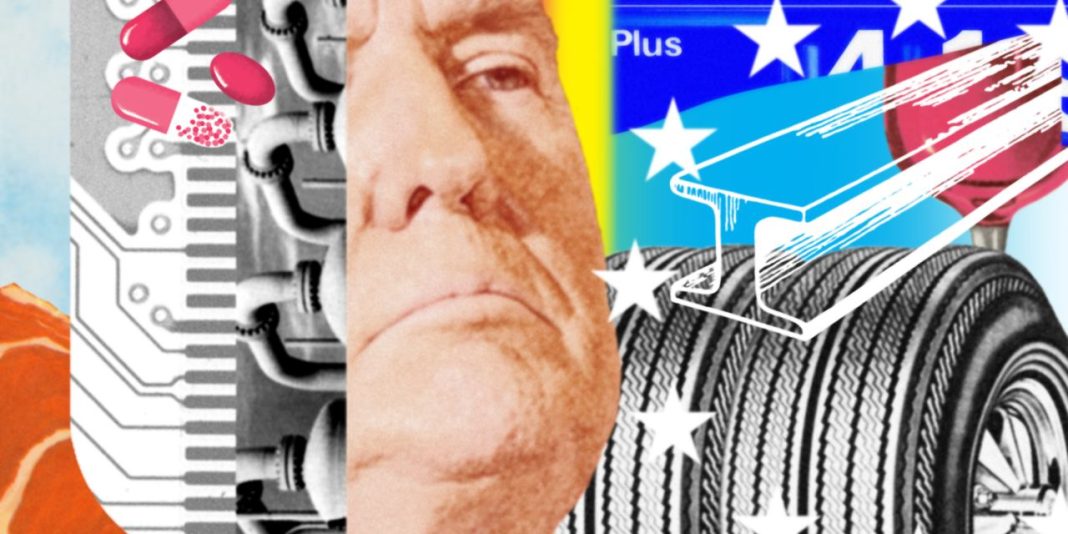

On Friday, January 23, 2026, the Wall Street bell rang to some sobering news. The Dow Jones Industrial Average, a key barometer of the US economy, experienced a notable drop. But the real buzz, or perhaps the ‘jhatka’, was around Intel. The semiconductor giant’s stock price faced a sharp decline, leaving many wondering about the broader tech sector’s health.

Why It Matters

While this might seem like news from faraway lands, global markets are super interconnected, much like our extended family WhatsApp groups! What happens in the US can send ripples across the globe, impacting investor sentiment even here in India. A downturn in major tech players like Intel can signal broader trends, potentially affecting supply chains and future investments. As a Mumbai-based market analyst put it, “When big players like Intel hiccup, everyone, including us, feels the draught a little.”

Bottom Line

So, what’s the takeaway? A single day’s dip isn’t the end of the world, but it’s a gentle reminder to stay updated on global market movements. Keep your investment strategies diversified and your eyes peeled, folks!