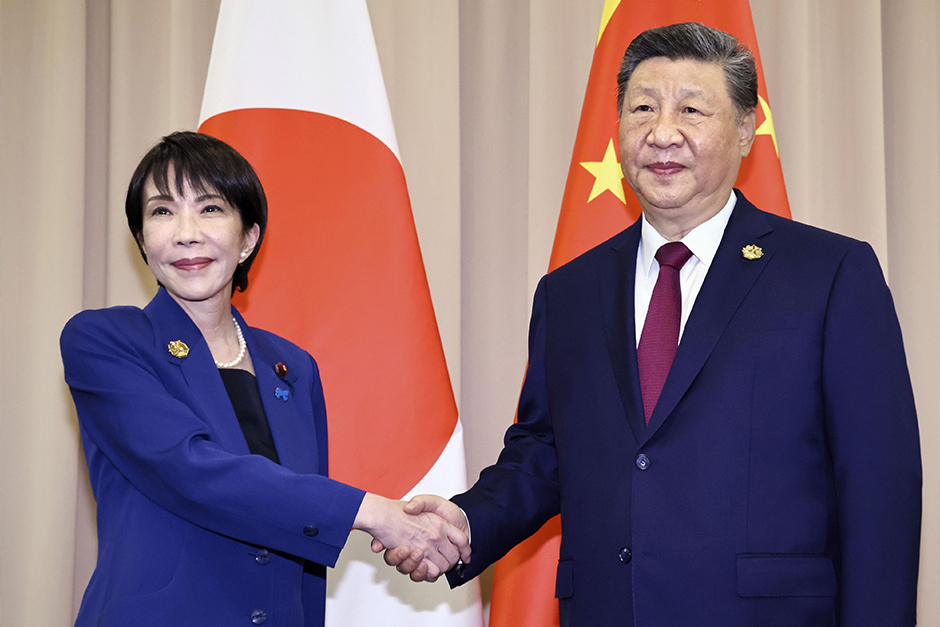

The global stage often feels like a delicate dance, and right now, the rhythm between two economic powerhouses, Japan and China, seems a little off-kilter. Whispers of discord are growing louder, and with them, a palpable anxiety is spreading through boardrooms and market floors worldwide. When two such significant players find themselves at odds, the reverberations are rarely confined to their borders. The big question on everyone’s mind? How might these deepening tensions impact an already sensitive global economy?

An Intricate Economic Tapestry

To understand the gravity of the situation, one must first appreciate the incredibly intricate economic relationship that Japan and China share. Despite historical complexities and ongoing geopolitical friction, their economies are deeply intertwined. China is Japan’s largest trading partner, and Japan is a crucial source of high-tech components, machinery, and investment for China. Think of the vast supply chains that crisscross the East China Sea – from advanced semiconductors to automotive parts, consumer electronics to raw materials. Any significant disruption, whether through trade restrictions, investment hurdles, or even just increased uncertainty, would send shockwaves through these essential pipelines.

For Japanese companies, the Chinese market represents not just a massive consumer base but also a critical manufacturing hub. Conversely, Chinese industries rely heavily on Japanese precision engineering and technology. “It’s like two halves of a single engine,” noted economic analyst Akira Tanaka. “If one side sputters, the whole thing risks grinding to a halt, affecting countless businesses and livelihoods that depend on their smooth operation.” This interdependence makes the current frostiness particularly worrying, as economic decoupling or even selective disengagement could prove incredibly costly for both nations and those plugged into their networks.

Beyond Bilateral Borders: Global Ripple Effects

The potential economic fallout from escalating Japan-China tensions isn’t just a bilateral concern; it casts a long shadow over the entire global economy. In an era where supply chains are already fragile and inflation remains a persistent worry, new friction points between major economies are the last thing anyone needs. Investors, always wary of instability, might pull back from the region, leading to decreased foreign direct investment and potentially stifling growth in other Asian markets that are indirectly linked. Currency fluctuations could become more volatile, and commodities markets might react unpredictably.

Consider the impact on multinational corporations that operate across both countries. They could face increased compliance costs, pressures to diversify supply chains, or even difficult decisions about where to allocate resources. This isn’t just about trade tariffs; it’s about the broader climate of trust and predictability that underpins international business. A climate of elevated political risk translates directly into higher economic risk for everyone. Smaller nations within Asia, heavily reliant on trade and investment from both Japan and China, would find themselves in a precarious position, caught between two economic giants and potentially forced to choose sides or navigate increasingly complex geopolitical waters.

The growing unease surrounding Japan-China relations is a stark reminder that economics and geopolitics are inextricably linked. While the complexities of their relationship are undeniable, the economic imperative for stability and constructive dialogue remains paramount. Both nations have much to gain from cooperation and even more to lose from prolonged tension. For the global economy, the hope is that pragmatism and a shared understanding of mutual economic benefit will ultimately guide these tense talks towards a more stable footing, easing the collective worry about a significant economic downturn.