The stock market often feels like a complex ecosystem, constantly shifting and reacting to a myriad of forces. Lately, it’s been a masterclass in nuance. Even as the S&P 500, a bellwether for large-cap U.S. stocks, registered two consecutive days of decline, the broader market narrative remains surprisingly muted: mostly flat. This intriguing divergence isn’t just a statistical blip; it’s a testament to the underlying dynamics at play, prompting investors to look beyond the surface headlines.

The S&P 500’s Recent Dip: A Closer Look

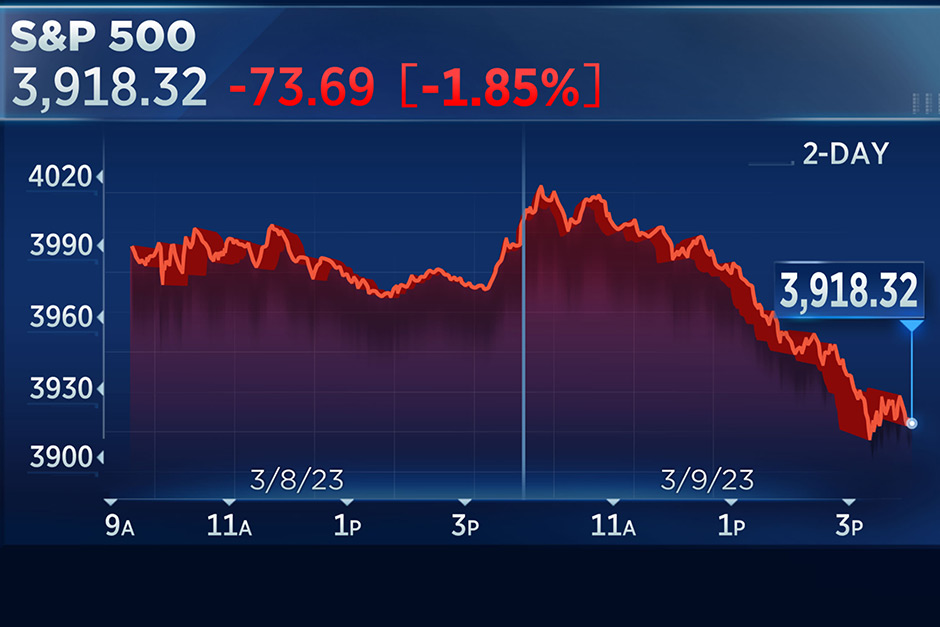

For two trading sessions, the S&P 500 experienced a noticeable dip, enough to catch the attention of analysts and investors alike. Such movements in a major index often trigger a sense of unease, conjuring images of broader market corrections. What might be fueling this particular slide? Several factors could contribute. We might be seeing a period of natural profit-taking after strong runs, especially in certain high-performing sectors that have led the market for much of the recent past. Concerns about stubborn inflation metrics, shifting expectations around interest rate policies, or even specific geopolitical developments can all contribute to investors re-evaluating risk and temporarily pulling back from positions.

It’s important to frame this not as a panic or a dramatic crash, but rather a measured retraction. The S&P 500, composed of 500 large companies, is sensitive to shifts in sentiment and economic forecasts. A couple of down days, while notable, often represent a recalibration rather than a systemic failure, especially when viewed against a broader, more resilient market landscape.

Why the Broader Market Isn’t Panicking

The real story here lies in the “mostly flat” status of the wider market. If the S&P 500, a key indicator, is down, why aren’t other indices and individual stocks following suit into a more pronounced decline? This resilience points to several factors that provide a sturdy floor for overall market sentiment:

- Sector Rotation: Money doesn’t always leave the market; sometimes, it simply moves. Investors might be reallocating capital from sectors that have seen significant gains (and now profit-taking) into more undervalued areas, or towards defensive stocks that historically perform better during periods of uncertainty.

- Strong Underlying Fundamentals: Despite some pockets of concern, various economic indicators – from employment rates to consumer spending in certain segments – might still be robust enough to prevent widespread pessimism. This underlying strength can reassure investors that the economy isn’t on the brink of a major downturn.

- Long-Term Investor Confidence: Many institutional and long-term individual investors view minor dips as noise, or even as buying opportunities, rather than signals to exit the market en masse. Their focus remains on longer-term growth trends and company fundamentals.

- Diversified Performance: Not every stock or sector moves in lockstep. While large-cap tech or growth stocks might pull the S&P 500 down, small-cap companies, value stocks, or specific international markets might be performing differently, preventing a uniform market slump.

As one veteran market observer recently put it, “Two down days in a major index can feel unsettling, but it’s crucial to look beyond the headlines. Often, these moments are more about rebalancing and minor profit-taking than a fundamental shift in market direction, especially when other sectors remain resilient and underlying economic currents are still favorable.” This perspective underscores the importance of a holistic view, rather than fixating on short-term index movements.

Navigating the Nuance for Investors

For individual investors, this current market dynamic offers valuable lessons. It’s a reminder that the market isn’t monolithic; its various components can tell different stories. While headline indices like the S&P 500 are vital, a truly balanced understanding requires looking at mid-caps, small-caps, different sectors, and even global markets to gauge the true breadth of investor sentiment.

This period calls for attentive observation, not panic. It highlights the importance of a diversified portfolio and a long-term investment horizon. Short-term volatility is a natural part of investing, and the market’s current “mostly flat” response to the S&P 500’s dip suggests a healthy degree of resilience and strategic reallocation, rather than a harbinger of deeper troubles. Staying informed and understanding the underlying reasons for market movements will always be more valuable than reacting impulsively to daily fluctuations.

This delicate balance between a dipping major index and a broadly flat market underscores the ongoing complexity and adaptability of the financial world. It serves as a compelling invitation to delve deeper into market mechanics and separate the signal from the noise.

*