Japan’s stock market is buzzing with an energy not seen in decades, shattering previous records and scaling all-time highs. It’s a remarkable turnaround, a testament to renewed confidence that has investors worldwide taking notice. But what’s fueling this incredible surge? Look closely, and you’ll find a significant part of that optimism is being pinned on a name increasingly echoing through financial circles: Sanae Takaichi. Her potential influence is inspiring a belief in a more vibrant economic future for the land of the rising sun.

The Phoenix Rises: Japan’s Market Momentum

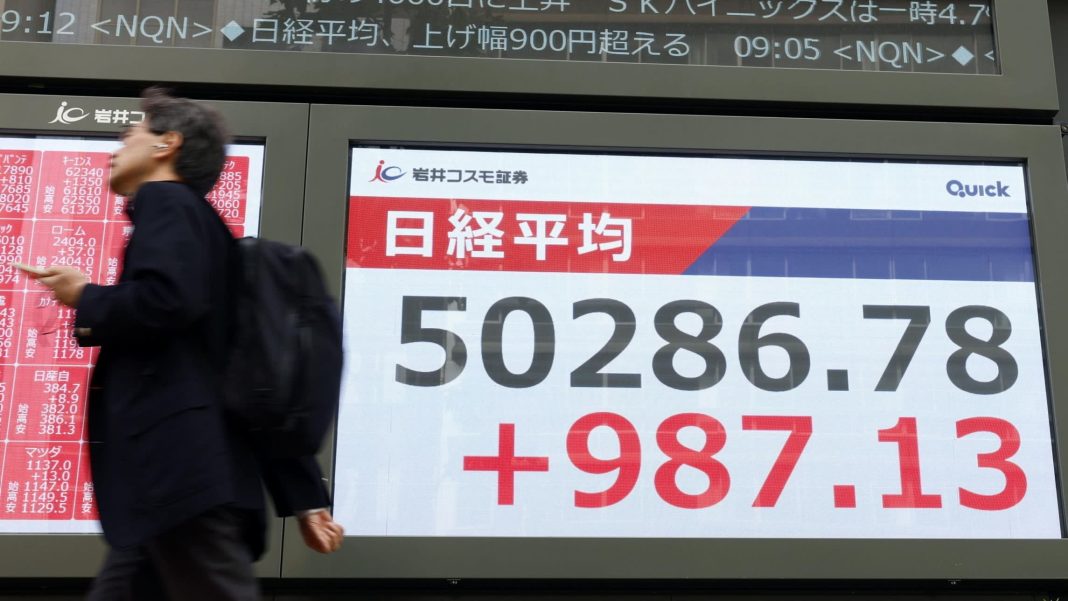

For years, talking about Japan’s economy often meant discussing deflation, stagnation, and an aging population. Yet, recently, the narrative has dramatically shifted. The Nikkei 225, Japan’s benchmark stock index, has soared past its 1989 bubble-era peak, a psychological barrier many thought would never be breached. This isn’t just a temporary blip; it reflects a deeper, more structural optimism. Foreign investors are pouring capital back in, domestic firms are finally seeing pathways to sustainable growth, and there’s a palpable sense of renewed purpose in the air.

This resurgence isn’t accidental. It’s built on a foundation of corporate governance reforms, a weaker yen making exports competitive, and a global economy that, despite its wobbles, still values Japan’s high-tech manufacturing and innovation. However, the current fever pitch of excitement points to something more – a belief in strong, clear leadership that can consolidate these gains and propel Japan even further.

The “Takaichi Effect”: Catalyzing Investor Confidence

Enter Sanae Takaichi. While not yet leading the nation, the anticipation surrounding her as a prominent figure, known for her staunch economic views and commitment to national strength, has already begun to ripple through the markets. Investors are interpreting her consistent advocacy for robust economic policies, an emphasis on strategic industries, and a no-nonsense approach to governance as a potential game-changer. There’s a feeling that under her possible influence, Japan would pursue policies geared explicitly towards growth, less red tape, and a clear vision for the nation’s economic future.

It’s this perception of stability, foresight, and a decisive hand at the helm that often acts as a potent elixir for investor confidence. Businesses thrive on predictability and a clear roadmap, and Takaichi’s public persona seems to offer just that. As one seasoned market analyst, Kenji Tanaka, put it recently, “Her reputation for strong convictions and prioritizing Japan’s industrial backbone is resonating. Investors see her as someone who could genuinely push for a new era of proactive economic stewardship, rather than reactive measures. It’s less about specific policies right now, and more about the faith in her fundamental economic philosophy.” This sentiment suggests a move away from the cautious approach of previous years towards a more assertive, growth-oriented stance that excites the capital markets.

A Glimpse into Japan’s Future

The record highs in Japanese stocks are more than just numbers; they are a powerful indicator of renewed belief in Japan’s economic trajectory. While many factors contribute to market performance, the significant role that optimism for Sanae Takaichi is playing cannot be understated. It highlights how leadership perception and the promise of a clear strategic direction can galvanize an entire market. As Japan navigates a complex global landscape, the “Takaichi Effect” stands as a symbol of hope that a decisive, forward-thinking approach could unlock even greater prosperity for the island nation.