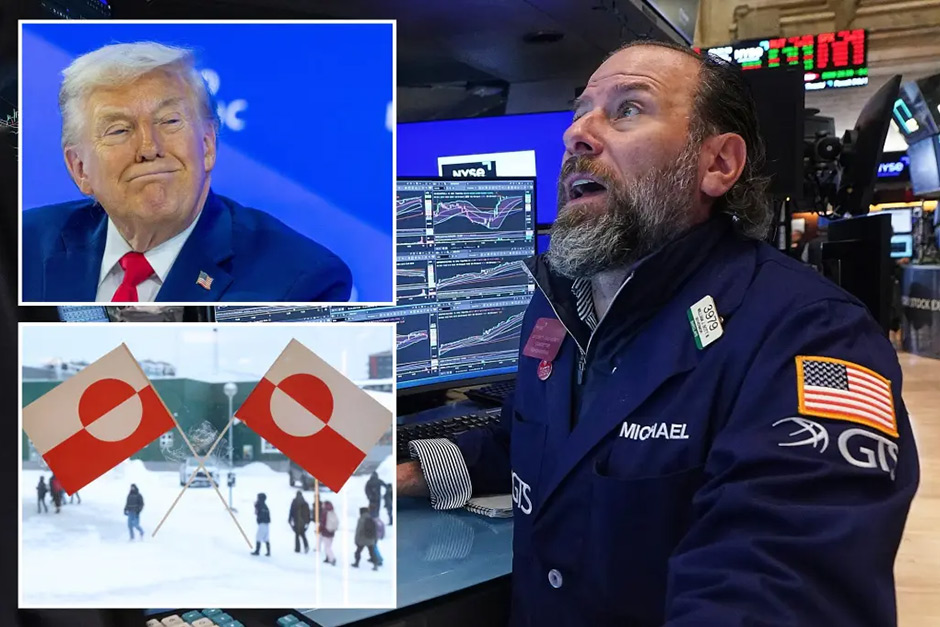

The financial markets are often a study in sentiment, capable of dramatic shifts based on signals that extend far beyond direct economic data. This past week offered a compelling example as the Dow Jones Industrial Average surged an impressive 400 points, marking a second consecutive day of strong gains. The catalyst? A seemingly unusual diplomatic move: the cancellation of proposed tariffs related to Greenland.

Market Momentum: A Surge of Relief

For investors, the sight of a significant upward swing in the Dow is always welcome, particularly after periods of uncertainty. The 400-point leap wasn’t just a number; it represented a palpable surge in investor confidence and a collective sigh of relief across trading floors. This wasn’t a slow, grinding climb; it was a decisive rally, suggesting that market participants were quick to seize on what they perceived as positive news.

What makes this rally particularly noteworthy is its timing and catalyst. It wasn’t triggered by an earnings report or a groundbreaking technological announcement. Instead, the market reacted to a diplomatic maneuver that, while specific, carried broader implications for global economic stability. This immediate positive reaction underscores just how sensitive the markets have become to political rhetoric and trade negotiations.

The Greenland Gambit: A Signal of De-escalation

At first glance, the connection between Greenland tariffs and a global stock rally might seem tenuous. Greenland, after all, isn’t a major player in international trade volume. However, the significance of the cancellation wasn’t about the direct economic impact of those particular tariffs. It was about the symbolism.

The initial talk of tariffs, even if hypothetical or retaliatory in nature, contributes to a climate of escalating trade tensions. Such a climate breeds uncertainty, and uncertainty is kryptonite for investors. When the administration announced the cancellation, it was interpreted as a step back from the brink, a willingness to de-escalate rather than intensify trade disputes. This gesture, irrespective of the specifics of Greenland, sent a powerful message: there might be a path towards reduced friction in international economic relations.

As one seasoned market analyst put it, “Investors aren’t necessarily cheering for Greenland, but they are absolutely cheering for any sign that global trade rhetoric might be softening. The market’s reaction here is less about the specifics of the tariffs and more about the perceived shift in diplomatic posture. It signals a potential easing of the pressure valve.” This sentiment-driven reaction highlights the interconnectedness of geopolitics and global markets.

What Does This Mean for Investor Confidence?

The rally serves as a powerful indicator of how much investors crave stability and predictability. Even a small step towards de-escalation can unleash significant pent-up demand and optimism. While no single event guarantees a sustained bull run, a two-day rally sparked by a diplomatic olive branch suggests that the underlying appetite for growth and stability is strong. Market participants are clearly eager for signals that reduce the risk profile of global trade and political landscapes.

This event underscores a crucial lesson: sometimes, the absence of conflict or the reversal of confrontational stances can be just as impactful on market psychology as any positive economic data. For now, the cancellation of the Greenland tariffs appears to have provided precisely that, breathing a fresh wave of confidence into a market often wary of the next geopolitical headline.

The Dow’s strong performance reminds us that markets often react not just to what is happening, but to what might not happen. And in this case, the market celebrated the idea of avoided escalation.

*