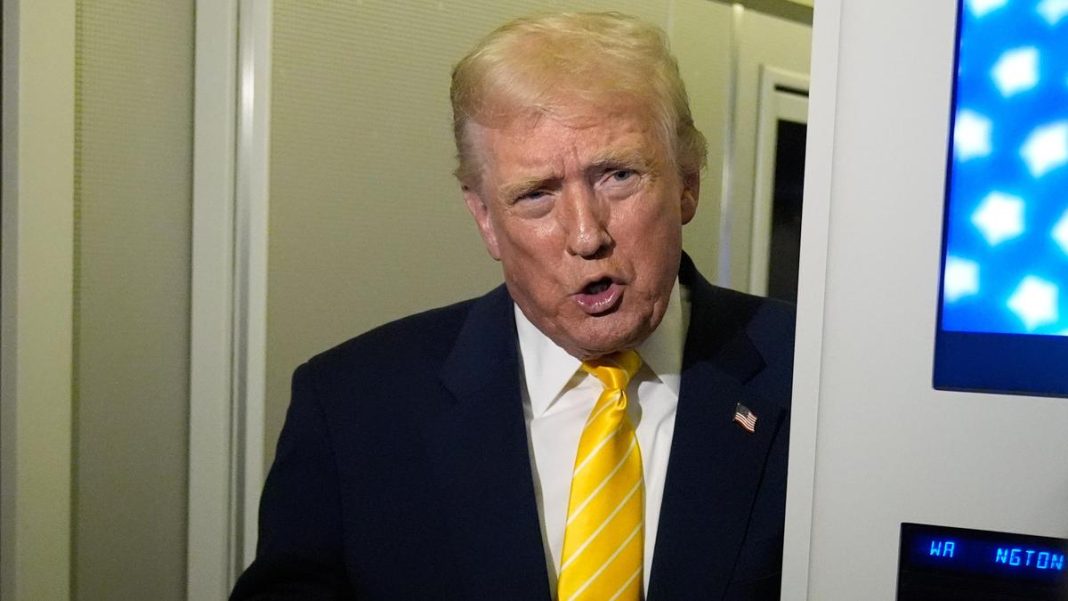

In a move signalling a potential recalibration of trade strategy amidst surging consumer prices, former U.S. President Donald Trump has announced a decision to drop tariffs on key commodities including beef, coffee, and tropical fruits. This move, as global and U.S. inflation persists, highlights the delicate balance between protectionist policies and consumer economic burden. For nations like India, deeply integrated into the global supply chain, such shifts in major economies like the U.S. carry significant implications, resonating across various sectors from agriculture to international trade.

A Strategic Reversal Amidst Inflationary Headwinds

Donald Trump’s political career has been defined by a protectionist stance, often involving tariffs to safeguard American industries. However, his recent declaration marks a notable departure, at least concerning these specific categories. The decision to remove tariffs on beef, coffee, and tropical fruits comes as the U.S. economy grapples with elevated inflation rates, directly impacting household budgets. With the cost of living a central issue in political discourse, especially with upcoming electoral cycles, easing these specific trade barriers appears a strategic manoeuvre to alleviate price pressures at the checkout counter.

Historically, tariffs on imported goods have increased their domestic prices as costs are often passed on to consumers. By eliminating these levies, the aim is to make these commodities more affordable for American households. While the direct impact on overall inflation might be modest, the symbolic gesture is potent, indicating a willingness to adapt economic policy to address immediate consumer distress. This pivot highlights a broader recognition that, despite their initial intent, certain protectionist measures can inadvertently exacerbate inflationary trends, particularly in a globally interconnected market.

Global Ripples: Impact on Supply Chains and Indian Consumers

The implications of this U.S. policy shift extend far beyond American borders, sending ripples through international commodity markets and potentially influencing trade dynamics for countries like India. India is a significant player in the global agricultural landscape, both as a producer and an exporter, making it sensitive to such global trade adjustments.

Consider coffee: India is a prominent coffee-growing nation. A reduction in U.S. tariffs could stimulate global demand by making it cheaper for American importers. While direct Indian coffee exports to the U.S. may not immediately alter dramatically, a general downward pressure on global coffee prices could influence the competitive landscape. Conversely, increased global demand due to U.S. tariff cuts could firm up international prices, potentially benefiting Indian growers and exporters.

For tropical fruits, India boasts vast domestic production and consumption, with a growing presence in the export market. While specific U.S. market access for Indian fruits has different tariff structures, a general global trend of easing trade barriers for tropical fruits could indirectly benefit India. If global prices adjust due to increased U.S. supply, it could create new avenues for Indian exporters or alter competitive pressures.

The case of beef (specifically buffalo meat from India) requires careful consideration. India is one of the world’s largest exporters of buffalo meat. A drop in U.S. tariffs on beef imports would primarily impact traditional beef exporters to the U.S., such as Australia, Canada, and Brazil. While India’s buffalo meat exports primarily cater to Southeast Asian, Middle Eastern, and African markets, changes in global beef prices due to U.S. market shifts can indirectly influence demand and pricing for Indian buffalo meat. As Mr. Arun Prakash, a senior trade economist, observed, “This move reflects a growing global recognition that protectionist measures, while politically appealing, often translate into higher costs for the average consumer, forcing leaders to reconsider their stance when inflation bites hard.” Such shifts compel Indian exporters to monitor global market dynamics closely.

Beyond Tariffs: A Glimpse into Future Trade Dynamics

This tariff reversal by Donald Trump could be interpreted in multiple ways. It might signal a temporary, pragmatic adjustment to immediate economic realities, particularly with an eye on the upcoming U.S. presidential election. Alternatively, it could hint at a more fundamental re-evaluation of protectionist strategies if their inflationary consequences outweigh their intended benefits. The global economy is currently navigating a complex period marked by supply chain disruptions, geopolitical tensions, and persistent inflation, making trade policies a crucial lever for economic stability.

For India, which has been actively pursuing free trade agreements and diversifying its export basket, understanding these evolving global trade dynamics is paramount. While India focuses on strengthening its domestic economy and expanding diverse international markets, major U.S. policy shifts inevitably shape the global trade landscape. This development serves as a reminder of the constant interplay between domestic economic pressures and international trade policies, underscoring the need for adaptive strategies for all global economic participants.

In conclusion, Donald Trump’s decision to drop tariffs on beef, coffee, and tropical fruits is a significant development, primarily driven by the imperative to ease consumer price pressures in the U.S. While its direct impact on India might be nuanced and indirect across different sectors, it highlights the intricate web of global trade. It underscores how policy decisions in major economies can create ripple effects, prompting nations like India to remain agile and strategic in navigating the ever-changing currents of international commerce and consumer economics.